After more than 25 years working in the multifamily industry, I have learned two important lessons. The first is that nothing good lasts forever. Interest rates will go up, budgets will get cut, and black swans will appear. “This time” is never different.

Winter will always be coming.

The second thing I have learned is that when the snow starts to fall, you will sleep a lot better at night if you have an asset class in your portfolio that provides consistent performance in all market conditions.

And for that, there is no better asset class than an impact-driven affordable multifamily housing property.

What Makes Affordable Multifamily Impact Investments Tick

Owners of affordable multifamily impact properties don’t rely on short term rent bumps, quick exits, or market timing to generate returns. They rely on maintaining affordable rents for a larger population of renters for a longer period of time. They provide resident services to support the people who call their buildings home. They keep a close eye on operating expenses, and they work with capital partners who share their long term approach to creating value.

What that means for investors is that affordable multifamily properties are more likely to benefit from high occupancy levels, longer lengths of stay, lower turnover rates, and reduced greenhouse gas emissions. And that makes it easier for property owners to maximize effective gross income, minimize operating expenses, and deliver stable and consistent returns in all market conditions.

Step One: Stable Credit Performance

Having led the affordable multifamily housing business at Fannie Mae in the midst of the 2008 financial crisis, I know a little bit about what it feels like to stare into an economic abyss. Back then, credit markets were frozen, capital markets were in free fall, and chaos was everywhere - especially at Fannie Mae. In the midst of all that uncertainty, we took a very close look at the credit performance of our multifamily book of business. What we found took many of us by surprise1. We found that over the course of the Great Financial Crisis, the credit quality of our affordable multifamily portfolio consistently outperformed our conventional multifamily portfolio2.

And when COVID-19 shut down the economy in 2020, history repeated itself. Market rate properties performed well. Affordable multifamily properties performed better.

Today, as the broader commercial real estate market finds itself navigating economic uncertainty, higher rates, and rising costs, affordable multifamily properties are once again holding strong.

Step Two: Consistent Cash Flow

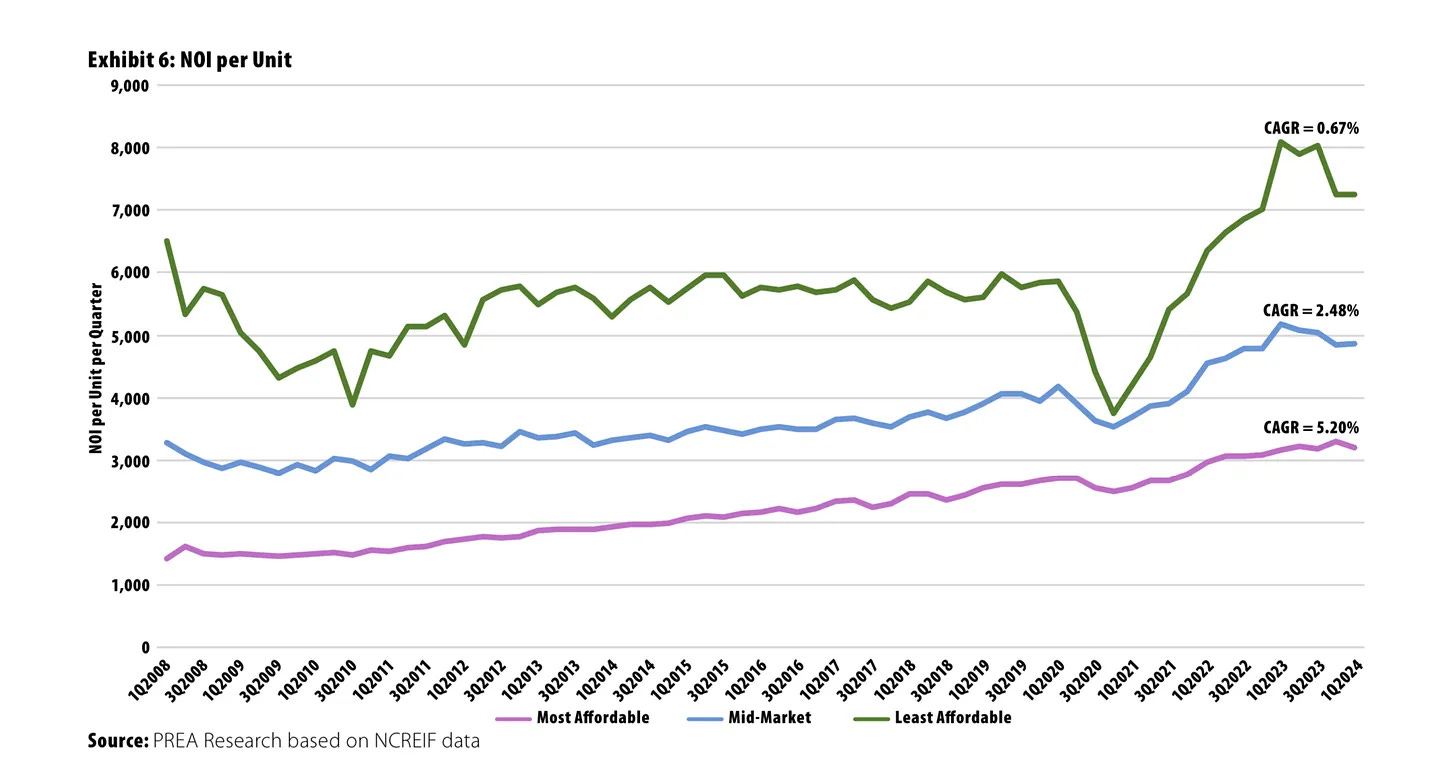

Owners of market-rate properties are more likely to rely on creating investor value by increasing rent, making minor property improvements and then selling or refinancing the property at a (hopefully) higher price. Conversely, owners of affordable multifamily properties take a different approach. They create value by leaning into long term property fundamentals. By keeping occupancy levels high and operating expenses low, affordable property owners deliver consistent NOI growth that supports long term value appreciation.

It’s a simple formula: when affordable multifamily property owners make it easier for people to pay rent on time and make long term investments that reduce operating expenses, they generate consistent cash flow that keeps investors happy when markets are angry. When markets go crazy, cash flow is the medicine that will help you sleep at night3.

While rent restrictions at affordable multifamily properties do limit income growth, they also make housing affordable for the people who live there. And that’s a big deal because when people can afford to pay rent - they are less likely to move, more likely to pay rent on time, and more likely to recommend their building to a friend. From an investor perspective, that means higher economic occupancy rates, fewer bad debt costs, lower vacancy-related costs and the potential for lower real-estate taxes. And that means stable and consistent net operating income (NOI)

This chart from the Pension Real Estate Association (PREA) illustrates that story perfectly. While market rate properties offer higher upside potential, affordable multifamily investments deliver more consistent NOI growth4.

Step Three: Longer Term Financing that Mitigates Interest Rate Risk

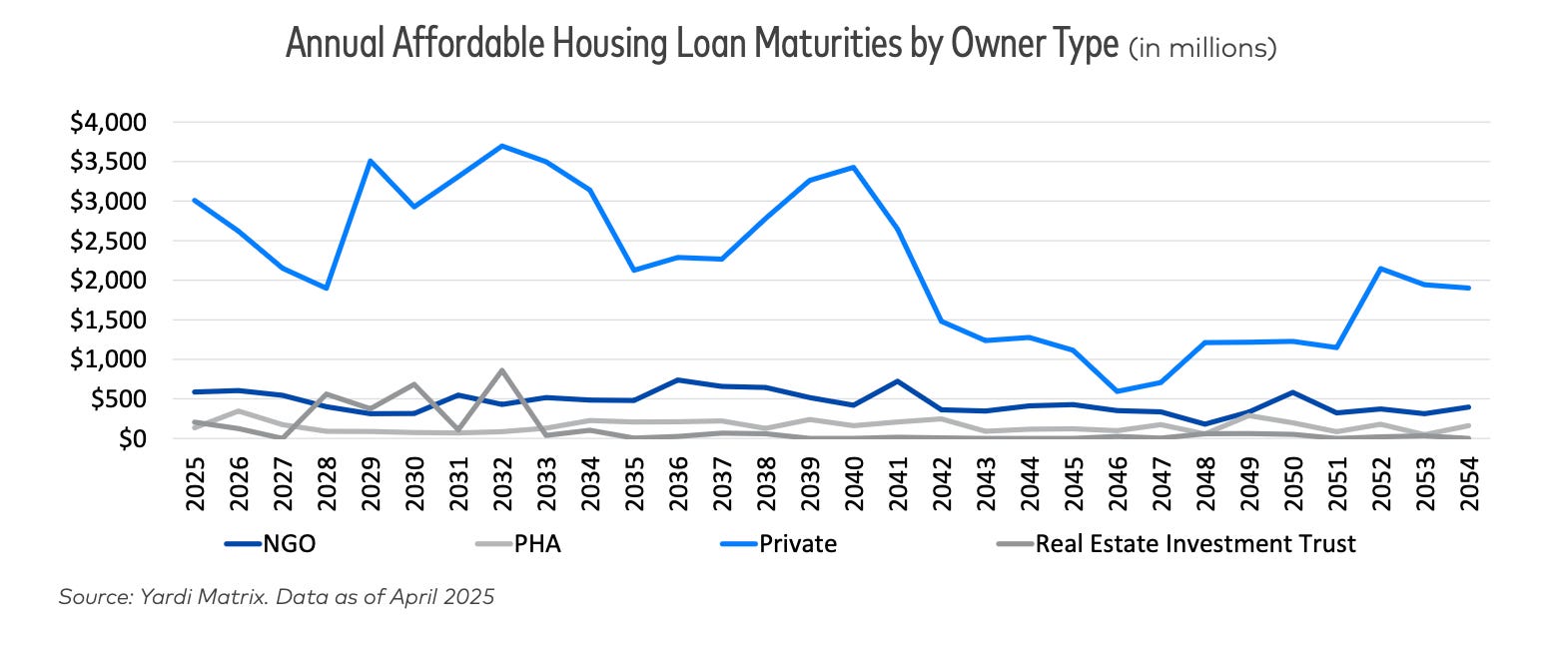

While there are a lot of headlines about the high number of loan maturities across the broader commercial real estate industry, those concerns do not exist in the affordable multifamily housing sector. Recently Yardi Matrix analyzed more than 26,000 affordable multifamily properties with $116 billion in debt outstanding. They found that less than 10% of those loans will be coming due in the next three years and 70% of those loans are held by banks who provide short term construction financing that is underwritten to support a long term permanent debt takeout5.

Unlike other multifamily asset classes, affordable properties are more likely to be financed with longer term fixed rate loans6 or bond financing. While this extends the hold period for equity investors, it also protects the property from short term interest rate swings or market uncertainty.

In other words, if you’re looking for a crisis, this is not the place. There is no wall of maturities looming in the affordable multifamily housing sector. Just a steady, manageable flow of loans that were built to last.

Affordable Multifamily Investments Are Good Old Fashioned Real Estate

From an investor standpoint, the longer term approach offered by affordable multifamily properties translates to consistency. You’re not betting on short term rent growth. You’re not betting on cap rates to compress. You’re not betting on rates to go down. You’re just investing in a property that generates consistent cash flow, is efficiently managed, and financed with longer term debt that is structured and underwritten to absorb interest rate fluctuations and market dislocations.

Some people might call that a multifamily impact investment. Others might simply call it a good old fashioned real estate investment. Both would be right.

And this is the headline that needs to be written. Affordable multifamily housing is a great opportunity to do good. It’s also a great opportunity to make a good investment. And while other corners of commercial real estate may offer a higher upside for growth when the weather is warm and the sun is shining, an affordable multifamily impact investment will always be there to help you sleep at night when winter inevitably returns.

No one in our affordable housing business was surprised.

In fact, the credit performance was so distinct, Fannie began including it in its quarterly 10-Q financial supplements. You can access those reports here.

There was a three month period in early 2009 when I thought whiskey was the best sleep medicine. Don’t judge me. I was not alone.

This allows the property owner to align their financing with tax credit compliance periods or other forms of subsidy.