Why Institutional Capital Is Moving Into Affordable Multifamily Housing

And how we are making it scale.

Over the past twelve months, a quiet but meaningful shift has started to happen in the affordable multifamily housing sector. Large pensions, foundations, family offices, and other long-term investors are allocating more capital into affordable multifamily housing investments that make the property more sustainable and improve the financial health and housing stability of the people who live there. They are not doing it because someone convinced them it was “the right thing to do”. They’re doing it because they recognize that investments in properties that conserve energy, waste less water and have more renters who can afford to pay rent on time perform better and more consistently across economic and credit cycles.

To help sustain that shift and make it scale, the Multifamily Impact Council (MIC) created the industry’s first and only common framework of impact investing standards for the multifamily sector. The framework establishes establish common definitions and reporting guidelines to provide investors, property owners, and policy-makers with a common language to assess and measure the financial and social benefits of affordable multifamily housing.

Since it’s introduction to the market in 2023, the Multifamily Impact Framework has been downloaded for use by over 600 organizations across the United States and is helping to turn what was once a messy and fragmented corner of the real estate market into a real, credible and investable asset class.

Here are some recent examples of how this approach is working and and setting the stage for more investments in the years to come.

Pension Funds

CalPERS, the giant California public employees’ pension fund, recently expanded a separately managed account with Nuveen focused specifically on affordable housing, bringing its total commitment to roughly half a billion dollars. This isn’t a side pocket. It’s not a “social experiment.” It’s a business strategy that focuses on long-duration, income-producing affordable multifamily assets that generate stable cash flow and credit performance over time.

The logic is straightforward: public pensions have long-dated liabilities and need predictable cash flow. Affordable housing delivers both. If you’re managing money for retired teachers and firefighters, it’s a safe bet1.

New York State Common Retirement Fund is heading in a similar direction, committing capital to Related Fund Management’s affordable housing vehicle. Again, the story is preservation, repositioning, and long-term value creation over time.

Then you have pooled structures like the American South Real Estate Fund, which is deploying capital on behalf of large public pension plans via intermediaries like GCM Grosvenor to invest in affordable and workforce housing assets.

All of these investments are good things to be doing. None of them would be happening if the underlying financial performance wasn’t there.

Endowments and Foundations

The California State University Endowment2 recently made a significant financial investment with the Bridge Investment Group - joining an ever growing list of university endowments who are are making strategic long-term investments in established affordable housing investment platforms.

Foundations are also getting in on the action. The Annie E. Casey Foundation, for example, has invested in a fund designed by Enterprise Community Partners to preserve affordable rentals while sharing a portion of property-level profits with long-term residents. This is not a one-time grant or rent concession3 , it is long-term private capital seeking profitable returns by improving the financial health and stability of the people who call their building home.

Family Offices and High Net Worth Individuals

Family offices, especially those with a stated interest in affordability and sustainability are also starting to put real weight behind affordable housing managers.

The Ballmer Group’s recent investment in funds managed by Avanath and the Vistria Group - targeting affordable and workforce housing - is a good example. This is not a donor-advised fund sprinkling grants. It’s a sophisticated investor backing experienced partners with successful track records.

Large family offices often play an outsized role in maturing an asset class. They can move faster than pensions, they’re more comfortable with emerging strategies, and they are often explicit about tying impact to long-term value creation. Once they’re in, it becomes much easier for bigger funds to follow.

Big Corporations and Large Employers

Amazon is an excellent example of a large employer who recognizes that their corporate success depends on maintaining a stable workforce with access to affordable housing. Through its Housing Equity Fund, the company has deployed more than $2.25 billion across Northern Virginia, Nashville, and the Puget Sound region with top-notch affordable housing managers such as Mercy Housing, LEO Impact Capital and the Clear Blue Company. Already, these efforts have helped create or preserve over 10,000 affordable homes in Seattle alone - many with 99-year affordability requirements baked in.

The company’s broader community investments reinforce the same theme: food-security funding, emergency-response support, and new facilities like Rainier Valley Food Bank all strengthen the foundation residents rely on to stay housed and stable. These aren’t just nice-to-have gestures; they’re a corporate acknowledgment that housing stability, community health, and workforce resilience are tightly linked to maintaining a stable and profitable business.

Profits Don’t Preach

For years, affordable housing was presented to investors as a moral imperative. Not surprisingly, that approach doesn’t work for investors with fiduciary responsibilities. But when you flip the pitch from “saving the world” to “strengthening the portfolio” those same investors are much more likely to pick up what the affordable multifamily housing industry is putting down.

And these are the things that belong in every affordable housing pitch to institutional investors:

Investor returns rely on people paying rent: Real estate investment returns don’t materialize out of thin air4, they come from people who pay rent on time and properties that don’t waste water or electricity. And when property owners invest in making properties more efficient and increasing the financial health and stability of their renters - they are not just improving lives and reducing greenhouse gas emissions. They are protecting your cash flow.

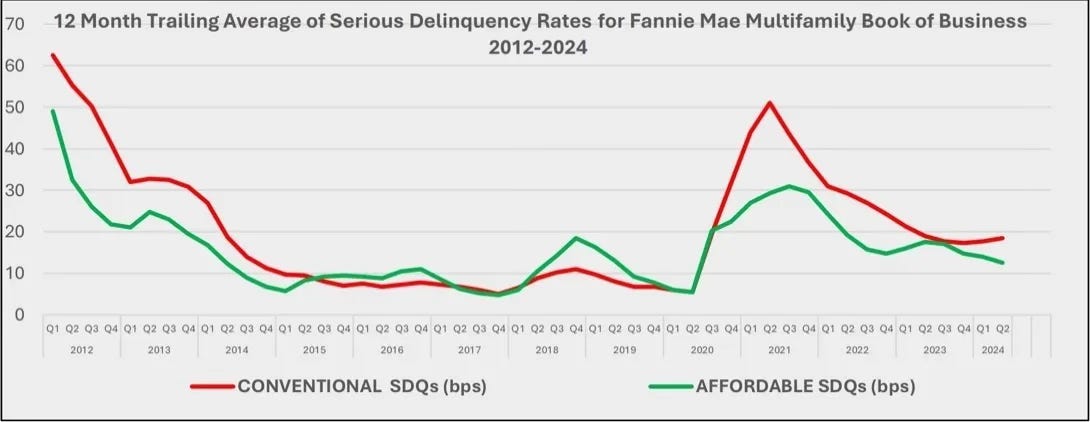

Affordable housing diversifies real estate portfolios: Rent-regulated and subsidized assets behave differently across cycles than Class A market-rate properties. Their serious delinquency rates are lower and less volatile, and they are less prone interest-rate swings and overheated valuations.

Creating impact is a risk-management strategy: Small investments in improving the financial health of renters, building performance5, and climate resilience help reduce bad debt, turnover costs, real estate taxes, utility bills and insurance premiums.

Investors should not ignore the social benefits. But we have to help them recognize that when property owners make buildings more sustainable and help renters improve their financial stability, they also just happen to be strengthening and protecting their financial investment.

Turning Unicorns into Horses

Asset classes with this kind of deep, symbiotic relationship between profit and purpose were once thought to be extremely rare. They were like unicorns. Hard to explain, difficult to quantify, and most people did not think they were real. The truth of the matter is that the affordable multifamily assets are not unicorns. They are horses. And if you know what you are doing and the conditions are right, they can thrive everywhere.

This is why we created the Multifamily Impact Framework6: To provide a common framework of clear definitions and consistent reporting standards that can be used as a field guide for the investors who are interested in allocating capital and the fund managers, property-owners and service-providers who are doing the work.

Crucially, the framework doesn’t just tell investors to invest “because it is a good thing to do.” Nor does it enable property owners to make empty and performative promises that don’t make things better (and often make things worse) for their renters.

It does help connect the dots between proven impact practices that create more affordable and sustainable communities and profitable, long-term financial returns and credit performance. And as more and more organizations use the framework to drive their impact strategies, it is becoming a universal translator that allows the affordable multifamily housing industry to demonstrate the unique way in which their asset class improves long term credit and financial performance in a language that institutional investors can assess and understand.

Good + Well = More

We’re still early. Affordable multifamily is not yet a fully defined box on every asset allocators menu, but a pattern is clearly emerging.

Pensions are scaling up. Endowments and foundations are proving concepts. Family offices are anchoring innovative investment strategies. Large corporations and employers are making larger and more significant long-term investments to support their workforce. And experienced affordable housing managers are proving that those investments make money because of their impact and not in spite of it.

When renters do good, investors do well. Maintaining a common framework of industry standards and reporting guidelines will help us all do more.

After all, the most impactful thing a pension fund can do is make sure their retirees get their monthly pension check.

When in doubt, read the financial statement. See page 34, paragraph (n)

It’s always struck me as odd that a business strategy where rents are consistently affordable to a greater percentage of the market and maintain higher rates of economic occupancy is less likely to considered to be considered as capitalism, than a business strategy that charges high rents to smaller percentage of the market and fills vacant units by giving away the first month’s rent for free.

Not anymore. May synthetic CDOs forever rest in peace.